Past performance is not a reliable guide to the future. But history shows that a balanced portfolio of FTSE 100 shares can help Stocks & Shares ISA holders like me build a big nest egg for retirement.

Britain’s leading UK share index delivered an average annual return of 7.48% between 1984 and 2022. Had I invested £25,000 at the start of that period and sat back, I’d have a very decent £234,138.06 sitting in my bank account.

That’s not bad. But I think I can do better.

Rather than investing in something like a FTSE 100 tracker fund, I prefer to search for individual stocks to buy. The two I’m currently considering buying are Ashtead Group (LSE:AHT) and JD Sports Fashion (LSE:JD.).

Millionaire maker

Why these particular stocks, you ask? Well, during the 2010s they were among the Footsie’s best-performing stocks.

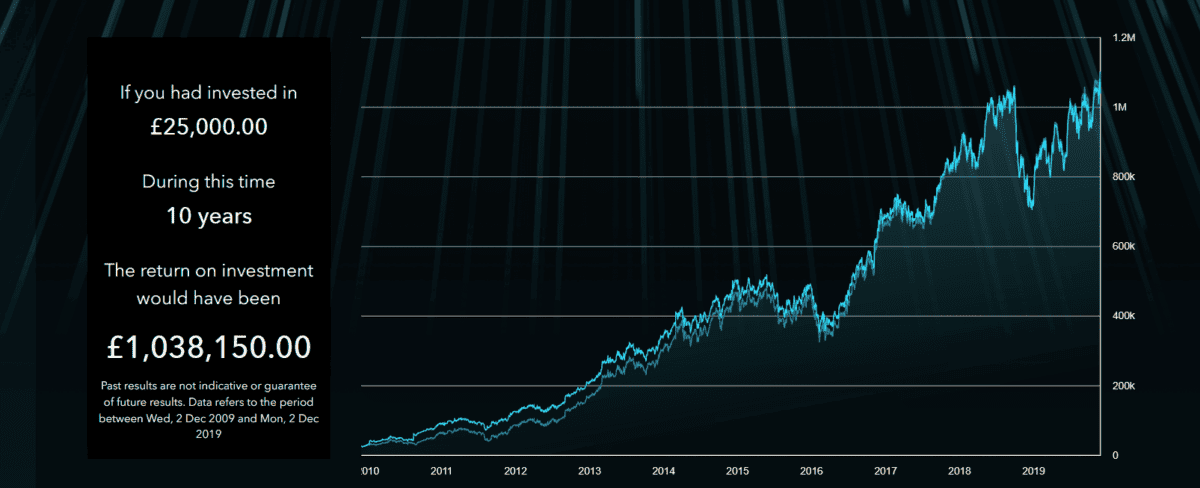

Take Ashtead, for example. An investment of £30,000 in the rental equipment provider on 2 December 2009, would have turned me into an ISA millionaire, as the chart below shows.

I’m confident that it could continue delivering smashing returns during the 2020s and beyond, too.

To reiterate my earlier point, there’s no guarantee that past returns can be replicated. But here is why I believe those FTSE 100 shares could help me in my quest to become a stock market millionaire.

Rental giant

I already own Ashtead shares in my Stocks & Shares ISA. Its successful acquisition-based growth strategy has formed the bedrock for electrifying profits (and thus share price gains) over the past decade.

And I’m hopeful this trend will continue: strong cash generation certainly gives it the means to continue growing its market share through additional bolt-on buys.

I’m also expecting market conditions to steadily improve over time, giving its revenues a big kick.

There is some uncertainty in the near term as high interest rates curb construction activity. But predictions of solid economic growth in the US — allied with increased infrastructure spending across its North American and UK markets — bode well for Ashtead over the long term.

Sports star

An investment of £30,000 in JD Sports on 2 December 2009 would have turned into £736,320 a decade later. While it could deliver disappointing returns in the near term, I still expect its shares to produce tasty returns for the 2020s as a whole.

Athleisure demand is under pressure at the moment amid weak consumer spending levels. This is especially the case in the FTSE 100 company’s US territory. However, the long-term outlook for this fashion segment remains highly promising, and especially at the premium end of the market where JD specialises.

Analysts at 360iResearch think the global athleisure market will grow at an annualised rate of 18.8% between 2023 and 2030. And JD, through its worldwide expansion drive, could be in a great place to capitalise on this.

I’m confident both these FTSE 100 shares will remain star performers. And I plan to search for more winning stocks to aid me in my quest to become a stock market millionaire.